High-end HDI leads with a growth rate of 16.3%, and the global market targets US$18.9 billion in 2029

The AI computing power arms race is setting off a profound change in the PCB industry. As the global AI server shipments soar at a growth rate of over 80%, the number of layers of traditional server motherboards has exceeded the 18-layer technical threshold, and the demand for high-end HDI boards has surged by 150%. The PCB industry has ushered in a key node for technological generational leap.

1. The growth rate of PCB in the server field leads other application fields.

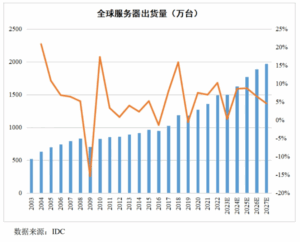

The application of PCB in servers mainly includes accelerator boards, motherboards, power backplanes, hard disk backplanes, network cards, riser cards, etc., and its characteristics are mainly reflected in the number of high layers, high aspect ratios, high density and high transmission rates. With the upgrade of server platforms, server PCBs continue to develop towards higher-layer boards, which puts forward requirements for the upgrade of technology and equipment. The Purely server platform corresponding to PCle3.0 generally uses 8-12 layers of PCB motherboards; the Whitley platform of PCle4.0 requires 12-16 layers of PCB layers; for the Eagle Stream platform that will use PCle5.0 in the future, the number of PCB layers needs to reach 16-18 layers or more. According to Prismark data, the unit price of PCBs with more than 18 layers is about three times that of 12-16 layers. According to IDC data, global server shipments will reach 14.95 million units in 2022, a year-on-year increase of 10.4%; IDC predicts that global server shipments will reach 19.71 million units in 2027, corresponding to an average annual compound growth rate of 5.7% from 2022 to 2027.

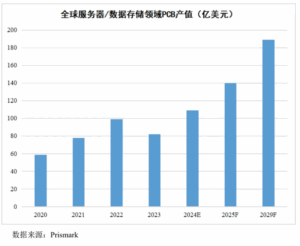

According to Prismark data, the server/data storage market size will be approximately US$291 billion in 2024, a year-on-year increase of 45.5%, far exceeding the growth rate of other segments of the electronics market. Due to the huge computing and storage requirements of emerging artificial intelligence applications, Prismark expects the server/data storage market to become the strongest growth driver for the entire electronics market in the next five years, with the market size expected to grow by 36.1% year-on-year in 2025 and an average annual compound growth rate of 11.2% from 2024 to 2029, leading other segments of the electronics market.

Benefiting from the drive of technologies such as artificial intelligence, data centers, and high-performance computing, the strong demand in the server market will drive the growth of high-end PCB product markets such as high-layer boards and high-end HDI. According to Prismark data, the global server/data storage PCB market size will be US$10.916 billion in 2024, a year-on-year increase of 33.1%, far exceeding the growth rate of other PCB application fields; it is expected that the global server/data storage PCB market size will reach US$18.921 billion in 2029, and will lead other PCB application fields with a compound growth rate of 11.6% from 2024 to 2029.

2. HDI is the largest incremental market for AI servers.

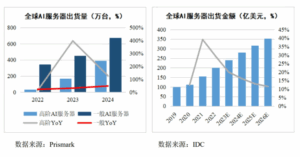

AI servers are the fastest growing type of server/data storage. According to IDC data, global AI server shipments will reach $24.1 billion in 2023 and $28 billion in 2024, a year-on-year increase of 16%. Among them, the growth rate of high-end AI server shipments will reach 128%. Among them, NVIDIA occupies a dominant position in AI server GPUs, and it is expected to ship 6.9 million GPUs in 2024, with a growth rate of 82%.

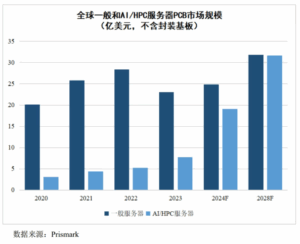

In the next five years, AI systems and servers will be the main driving force for the growth of PCB demand. According to Prismark data, the global PCB market size for AI/HPC server systems (excluding packaging substrates) will be close to US$800 million in 2023, and is expected to reach US$1.9 billion by 2024, a year-on-year increase of nearly 150%; by 2028, the PCB market size for AI/HPC server systems (excluding packaging substrates) will catch up with general servers, reaching US$3.17 billion, with an average annual compound growth rate of 32.5% from 2023 to 2028, far exceeding the growth rate of PCB market size in other fields. AI servers and HPC systems have become an important driving force for the development of low-loss, high-layer boards and HDI boards.

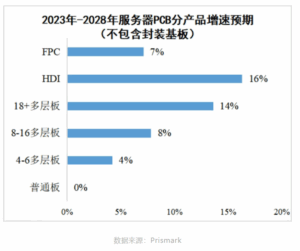

AI servers mainly involve three products: the GPU substrate requires a high-layer board with more than 20 layers; small AI accelerator modules usually use 4-5-order HDI to achieve high-density interconnection; traditional CPU motherboard. In addition, as AI servers are upgraded, GPU motherboards will also be gradually upgraded to HDI, so HDI will be the fastest growing PCB related to AI servers in the next five years, especially the demand for high-end HDI products above 4 orders is growing rapidly. Prismark predicts that the average annual compound growth rate of HDI related to AI servers will reach 16.3% from 2023 to 2028, which will be the fastest growing category in the AI server-related PCB market.

When the annual shipment of AI server GPUs exceeds 6.9 million, and the value of a single server PCB reaches three times that of traditional equipment, this wave of advanced PCBs driven by the computing power revolution is irreversible. From the rigid demand for 18-layer boards on the PCle5.0 platform to the accelerated penetration of HDI in GPU modules, technological iteration is reshaping the industry’s competitive landscape. For PCB manufacturers, breaking through the manufacturing bottleneck of 20-layer high-layer boards and conquering precision processing technology for HDI above level 4 are not only technical answers to the explosive growth of AI computing power, but also the key to opening the door to the trillion-dollar data center market. In the 11.6% compound annual growth track predicted by Prismark, only companies that tilt their R&D resources toward core technologies such as high-speed materials and ultra-micro hole processing can gain the upper hand in this computing power-driven industry upgrade.